Bitcoin leaving Derivative Exchange Wallets? But why?

On-chain update 21st March 2021

We have a signal people, something happened.

I’ve got a spooky feeling from the market the at the moment, as mentioned in the previous post, it’s too quiet in here.

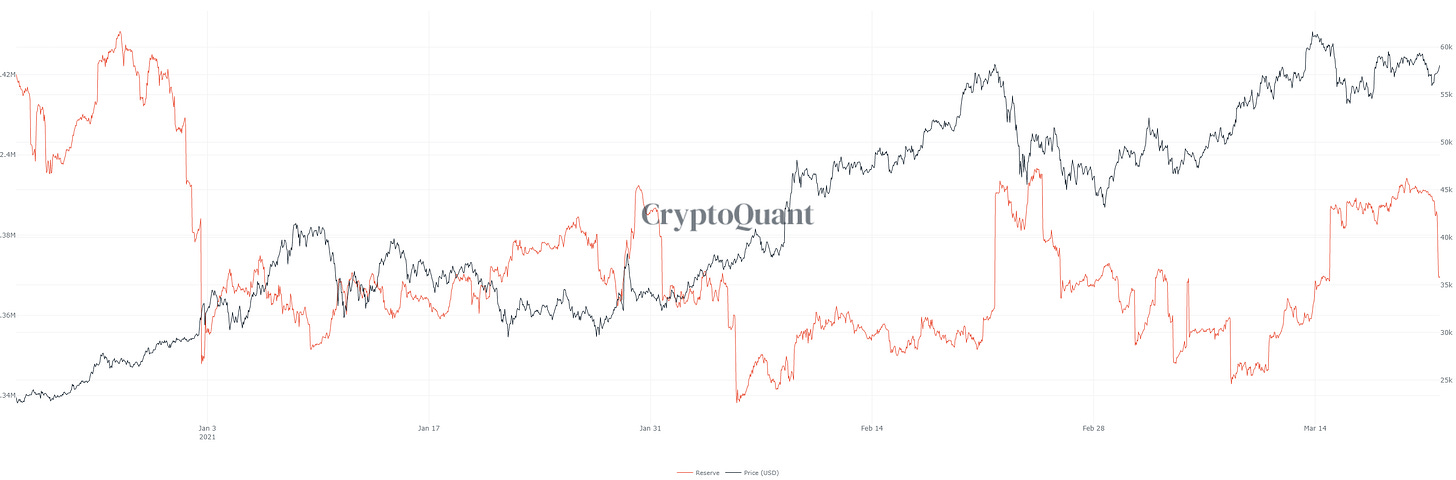

Or it was, until I opened the BTC All Exchange Reserves chart; in the last two posts I’ve talked about a bunch of BTC that turned up on the spot market and with Stablecoin levels not exactly pumping, this made me a little nervous.

Well, look what we have here, a bunch of BTC leaving exchange reserves.

BTC All Exchange Reserves:

I’m going to throw a bit of TA in here, I noticed that the dumping we’ve been seeing this weekend looks oddly systematic, or manipulated. Manipulation happens all the time, it’s the name of the game in the derivatives market. For big players they not only have the ability to drive price in a certain direction, they have to because of liquidity.

If you’ve got a $1bn derivative long you want to open but only $500m of shorts to sell to, you need to find liquidity from somewhere.

The way you do that is by taking advantage of limit orders on the order book. Stop losses, when tripped, are sell orders and liquidations are also sell orders.

So, drive price in a certain direction until you trip enough stops or liquidate enough positions to create enough sellers to fill your long position.

That’s exactly what I think we’ve seen this weekend. May I present, Exhibit A:

If you bought the support at around $58.3k for a leveraged long position, where would you put your stop loss? Probably on the red cross at $56.3k or just below since if price goes down that far, we’d we posting a lower low and breaking bullish trend patters of higher lows.

You see this all the time in the market and it’s called a stop run. Most often it occurs where you have two or three equal lows or highs but it still works on one like this, especially when we’re approaching all time high.

The grey shaded rectangle is also a support area I’ve had marked out for a while so it makes sense that there would be a lot of liquidity here.

Spot Market vs Derivatives Market

You know what’s funny here? This decrease didn’t come from Spot Exchange Wallets, it came from Derivative Exchange Wallets.

BTC Spot Exchange Reserves:

BTC Derivative Exchange Reserves:

It’s clear as day. Which means the Bitcoin on the spot market that turned up last week is still there. Not feeling as bullish now right?

This is confusing no doubt because Bitcoin leaving derivative exchange wallets is not as clear cut in it’s bullish / bearish bias and with not much going on around Stablecoins, I’m unsure what to make of it.

If anyone has ideas, please, post them in the comments section below! Would love to start a discussion.