On August 18th, 1977, Jerry Ehman was pouring over a pile of printouts from the Big Ear radio telescope.

It was Jerry’s job to investigate the vast array of numbers, searching for anomalies and highlighting anything that stood out amongst the drone of background noise.

On this day, something radically different caught his attention. He grabbed his pen and circled a strange sequence of numbers, excitedly scribbling the word Wow! next to it.

Named the Wow! signal, a full 72 second window in which the Big Ear telescope recorded a strong radio signal which bore hallmarks of an extraterrestrial transmission.

It was hidden amongst the drone of background noise, a signal in a haystack.

This is what happened on ethereum today, but instead of alien radio transmissions, it was an unusual inflow of ETH onto exchanges.

Let me explain…

The Analysis

Last week we witnessed unprecedented demand for Ethereum resulting in over 80% price appreciation, a lot of this occurred over the weekend and last Friday I wrote about the perfect concoction that was brewing over on the Espresso: A Perfect Concotion: ETH

This morning, ears were pricked and traders eagerly awaited a correction that was sure to come.

I woke up early this Monday morning, and was greeting with positive exchange netflows of bitcoin and ethereum.

Netflows were showing more supply telling us there’s more selling pressure. At the same time, stablecoin netflows had been negative all weekend showing a lack of demand.

Combined with technical analysis showing bitcoin pushing up against resistance:

And Ethereum pushing the top of this broadening wedge:

When you have this combination, increased supply, lack of demand and price struggling against resistance, it usually means we’ll see lower prices.

But how low will prices go and what sort of dip will we experience?

This started to unfold as the day drew on and on-chain signals began to reveal the picture before it happened.

But these signals are subtle and have to be interpreted carefully.

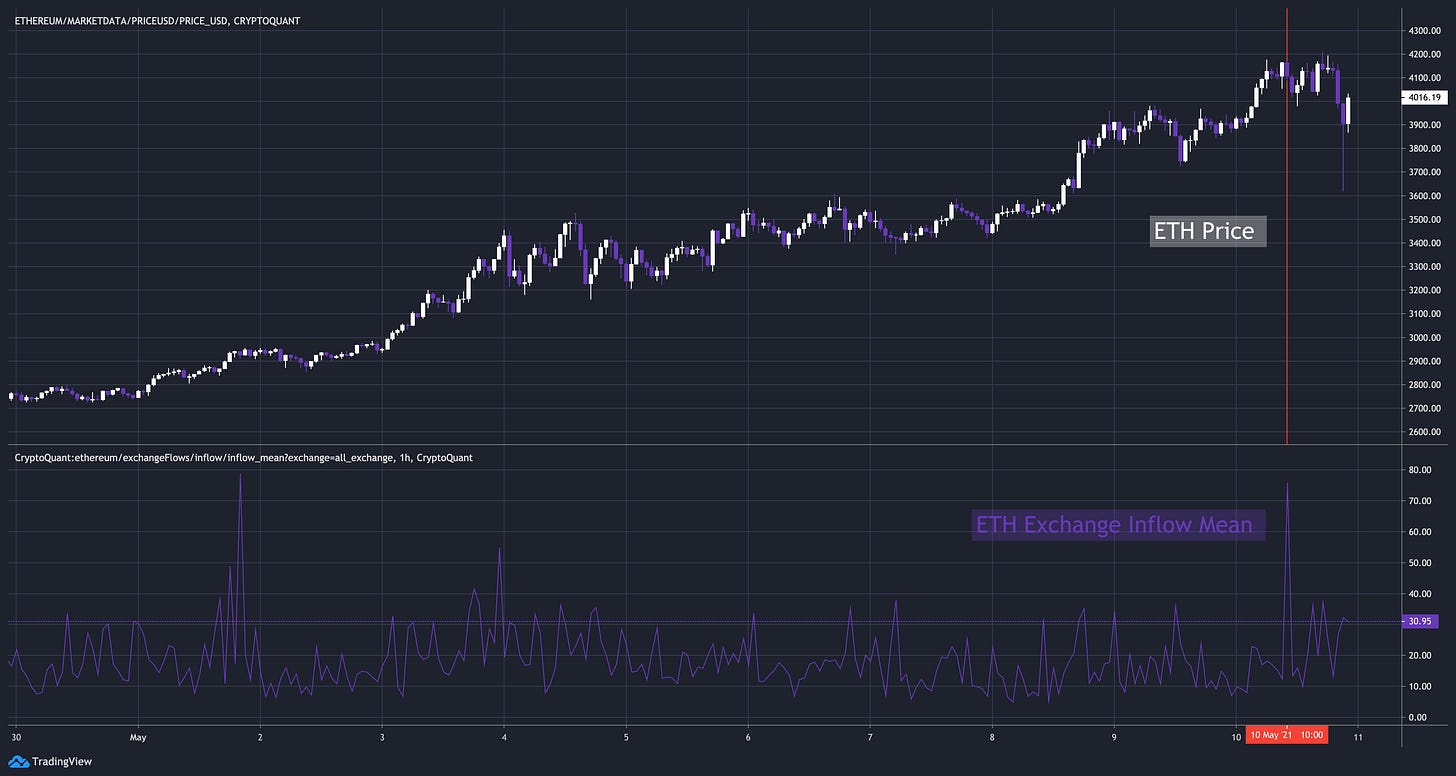

Needles can often be found in exchange inflow means. When inflow means of bitcoin or ethereum spike, there has been an unusually large amount transferred onto exchanges. This can be bearish as a large amount may have turned up to sell.

That’s what we saw this morning on ETH, a signal amongst the noise, an unusual amount transferred onto exchanges:

Then a few hours later, price dipped sharply by $500 from $4.1k to $3.6k followed by a quick recovery back to $4k. You had to be fast to catch this knife.

If inflow means of ethereum are the bearish signal, what’s the bullish equivalent?

Stablecoin exchange inflow means could be one, since it implies buying pressure, and right before the dip, we got a spike on this:

I think this could explain why we saw such a fast recovery on ETH. There was a lot of buying pressure ready to absorb the dip. The inflows can be subtle and have to be deciphered from the background noise. Put it together with exchange netflows and technical analysis to gain an edge.

Serving on-chain cuts.

@tempting_beef